Calculating Terminal Value

Introduction

In this article we introduce the terminal value calculation; in particular it's application in a project finance financial model. We intend you to read this with the accompanying Excel workbook so you can review the layout of the calculations and the actual formula - rather than just read about it. If you find this useful and you want to understand more about the intention, interpretation and market nuances of the terminal value ask us about our two day, 100% hands-on, case study based, Project Finance Analysis course, delivered in person by Nick Crawley.

When an asset has a life is longer than the period covered by the financial model and the growth rate of that asset is deemed stable over that remaining life it makes sense to calculate a terminal value to attempt to capture the full value of the investment in the project.

Project finance assets are by their nature highly contracted, hedged and insured and show relatively low and stable growth during normal operations and relatively low risk refinancing as the asset matures. This remarkably long-term stable nature of project finance assets makes them well suited for the application of a terminal value – especially for an owner or equity investor who require a regular formal valuation for compliance and reporting of the life-time value.

In this post, we cover the essentials you need to know, these are also performed and discussed in our Project Finance Modelling training course.

- Where does the terminal value appear?

- Four methods to calculate a terminal value.

- The information you will need before you start

- Common errors found in the financial modelling of terminal value

- Our checklist

Where does the terminal value appear?

The terminal value is often of little consequence to project finance lenders but of vital importance to the investors in and the owners of project finance assets. It is a proxy which is added to the last modelled cashflow to represent the net value relating to all of the periods beyond the last modelled period which you want to capture.

Four methods to calculate a terminal value

There are several ways to estimate the future value of an asset, it is best not to get too scientific as these whatever you choose the results are, at best, educated guesses with a wide range of error but you may as well use the most suitable mathematical logic – it’s usually a good starting place!

- Perpetuity

- Annuity

- Growth annuity (our favourite!)

- Multiple of EBITDA

Structuring a terminal value calculation in a financial model

Successful project finance modelling starts with a clear layout of the key information you require for each section of your calculations as well as clearly identifying the assumptions you are making. It is about making it efficient for you to test and debug as much as it is about making it easier for another user to readily understand what is being calculated. Think of it as you are leading an unfamiliar, but qualified, user through a story in a way they can obtain confidence in what is happened at each step along the way.

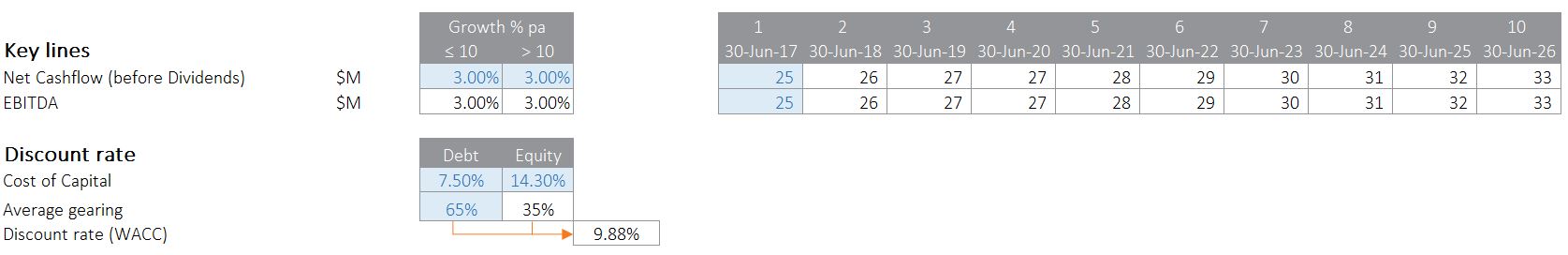

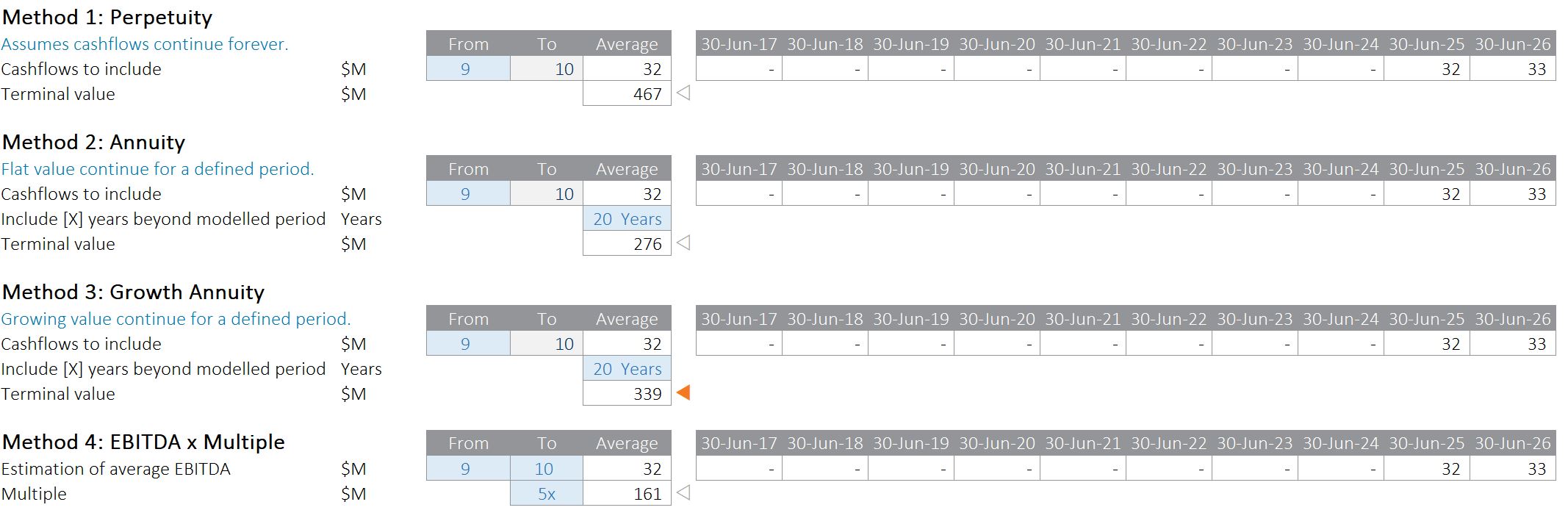

The screenshots below are from the attached workbook and show how we visually separate assumptions from calculations. Whilst a one worksheet post like this is different to a ‘proper’ project finance model you can see that order and layout are very important.

Referring above we illustrate

- Assumptions clearly presented in a consistent and clear. Here the style is blue on blue.

- Each line has a concise but clear title and units or symbol

- Time series have dates clearly presented

Referring above we illustrate

- Give calculations clear headings and ‘breathing room’

- Keep time independent assumptions and in-sheet workings to the left of a time series.

- Advanced tip: Highlight a ‘live’ section with something like the orange pointer

Preparing the essential information before starting calculations has two advantages

- You have a ‘home’ for all subsequent inputs you realise are needed

- It helps you resist the urge to build assumptions into formula – a cardinal sin in financial modelling

Common errors found in Terminal Value calculations

Conceptual

The terminal value is not an actual cashflow and as such it should not appear in a financial statement; keep in mind that it is only a mathematical estimate to improve the meaningfulness and accuracy of a Valuation. EBITDA multiple is a well-known, back of the envelope way of benchmarking one investment against another, in particular of going concerns in well-known industry sectors. In project financings, terminal value warrants more rigor.

Mathematical

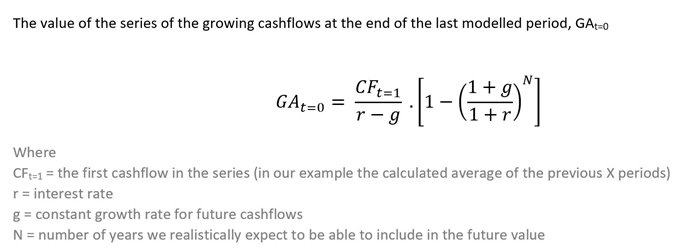

Let’s take a step back and look at what we are actually trying to do in real life and then choose the most meaningful mathematics. We want to calculate a value to use in the last modelled period that represents the present value, in that last period, of the value of the following N years of cashflows which are growing at a rate “g” and discounted to that last modelled period at a rate “r”. It is not reasonable to assume that these cashflows do not grow and go on forever….and that is why we do not advise the use of the perpetuity – a common mistake. You will see in the comparison below that it pays to know your financial mathematics!

The formula for the growth annuity is one of the few that are worth memorising.

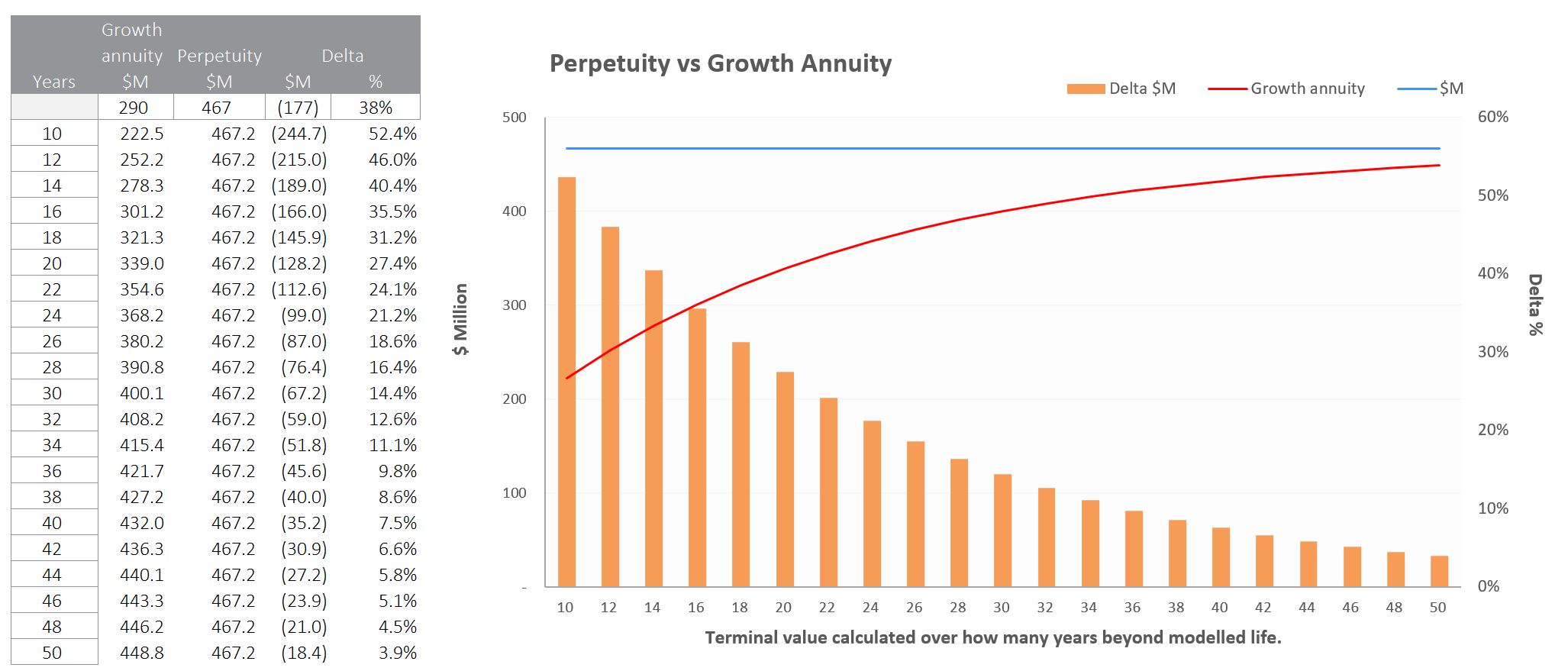

Comparing a perpetuity to a growth annuity

Using very typical assumptions and net cashflow values we arrive at a Terminal Value of $339M and a total value to shareholders of $577M

- Cashflow in the first period after the end of the model = $32.14M

- Discount rate = WACC = 9.88%

- Growth beyond modelled period = 3.00% p.a.

- N = 15 years.

If we calculate our Terminal Value using a perpetuity which is CFt=1 / (r-g) we get $467M and a total value to shareholders of $754M. Comparing these two values shows that the choice of Terminal Value calculation we adopt in our project finance model is important! Looking at how this delta varies as we change N further highlights the materiality of this issue. Even at 30 years the perpetuity is still over-valuing the Terminal Value by almost 15%.

Our checklist for the financial modelling of terminal value

Here are a few checks that will help if you are working with terminal value.

- % of the total shareholder value that is contributed by terminal value, however it is calculated.

- Real or nominal cashflows – affects your growth and WACC

- Growth annuity or EBITDA multiple

- Choice of Growth and discount rates

- Is discounting taken back to the beginning of the model / valuation date correctly

- Suitability of the period over which you average the cashflows or ebitda

- Stability of cashflow growth rate

- Clearly label the units, method selected and if the value is before or after tax

- Include the terminal value in metrics only – not the financial statements

Summary

If you found this helpful and would like to learn about other aspects of Project Finance Modelling or advanced Financial Modelling then you would love our training courses! Check them out here or just give us a call.

I hope that was useful – smooth and happy modelling!